As a newcomer, one of the essential things you need to know is the country's tax system. Canada's tax system is the means by which the government raises revenue to provide essential public services such as healthcare, education, and infrastructure.

Taxes are a fundamental part of Canadian life, and understanding how they work is crucial to living and working in Canada. In this blog, we will provide an introduction to Canada's tax system, why it exists, and what it is used for. We will also discuss what you get taxed on and the different types of taxes that apply in Canada. Whether you're a student, a professional, or a new resident, this guide will help you understand the basics of Canada's tax system and navigate the tax landscape with confidence.

What is the Canadian Income Tax Rate?

Canada offers an extremely high quality of life to its residents. It’s so high, in fact, that Canada has ranked as the number one country offering the best quality of life globally.

With an incredibly high living standard, free healthcare, and up to secondary education for its residents, all of the financial resources to benefit close to 38 million residents must come from somewhere. This is why there is a much higher-than-average tax rate in Canada than in most other countries.

While you may have heard that Canada's tax rates are very high, they are actually lower than America’s. There is an ongoing debate that Canada has higher income tax rates than its American counterparts, which has been ongoing for quite a long time, yet the Internal Revenue Service (IRS) for CRA taxes some of the richest Americans 37%, and Canadians only 33%. Although Americans benefit with their low mortgage interest deduction rates, Canadians who make less than $84,200 that don’t own a home, are likely to pay much less tax. Additionally, Canadian taxes goes toward providing free healthcare and education, which the US does not provide to the same degree across the country.

In Canada, you can expect many different types of taxes, including land transfer tax, sales tax, gas tax, liquor tax, and even custom tariffs on imported goods. You can also expect to pay tax on assets, including property taxes and income tax, as in any other country too. While tax is not something many people bother to be informed about, it is something that we must all pay, as there can be consequences for those who don’t pay it.

When in Canada, for every dollar you make, you must pay tax on it, which is otherwise known as income tax. While tax is recognized as something we encounter daily worldwide, it used to be thought of as something that the Canadian government resisted. Now, high taxes promise Canadians a high quality of life. Canadian residents understand that they are paying for their quality of life and know that the country offers the best there is, which makes every tax dollar owed worth it.

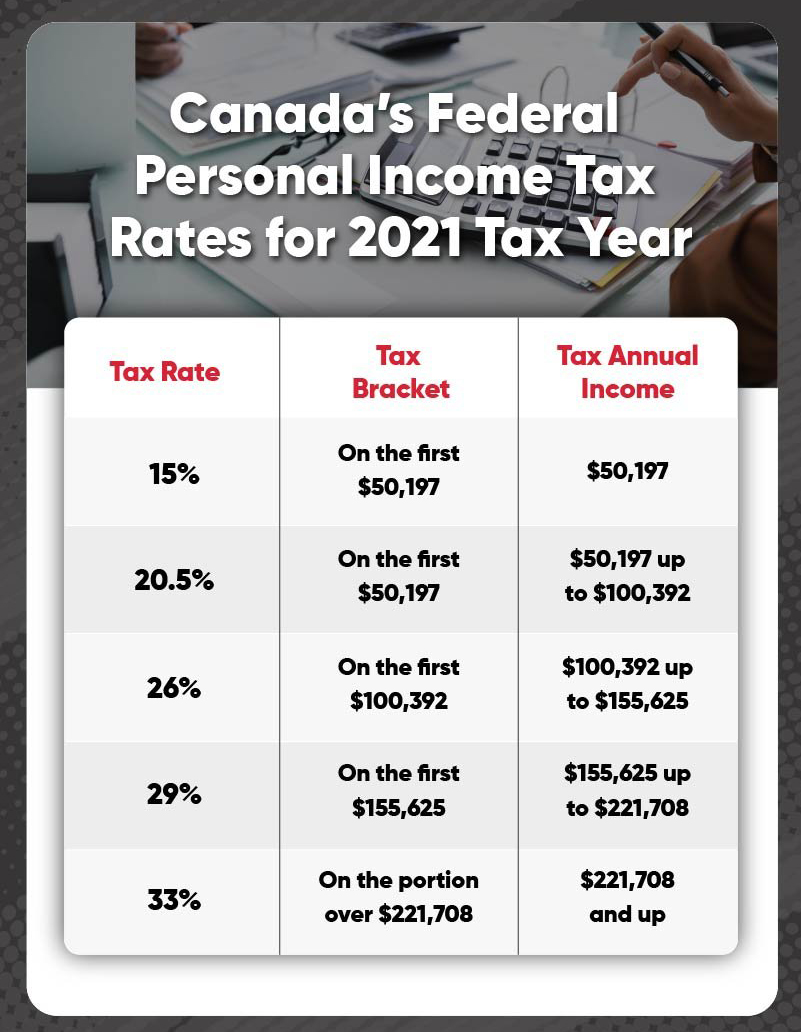

Today, married couples and single individuals have identical federal personal exemptions at about $13,230. The top federal tax rate is 33%, and with provincial tax rates, the total marginal tax rate is 53.53%. While most people pay income tax, 33% of Canadians don’t, which is about 9 million people. For those who do pay tax, this is usually considered among the top biggest expenses on their budget, which contributes to a high cost of living in Canada. Nevertheless, higher living costs are supported by higher than average salaries across industries. Collectively, Canadian tax makes up $265 billion each year, which is directly allocated to the government. This amount makes up 50% of the country’s revenue.

The tax rate in Canada is high because it pays for the country’s military, police force, operating expenses, delivery services, libraries, hospitals, high schools, prisons, roads, and the CBC. A large amount of taxes are also directed to lower-income Canadians or residents living in poverty as child benefits, social assistance, employment insurance, and old age security.

Canada has a variety of tax credits and benefits available to individuals to help reduce the amount of taxes they owe and provide financial support for specific situations. Some common tax credits and benefits include the Canada Child Benefit, the GST/HST Credit, the Disability Tax Credit, and the Medical Expense Tax Credit.

Taxable Income

- Employment income

- Self-employment income minus expenses

- Dividends

- Interest

- Pension income

- Income from selling stocks, investment property and bonds

- Withdrawals from RRSPs

- Foreign Income

- Corporate income minus expenses

Non-Taxable Income

- Lottery winnings (most)

- Child benefit payments

- Inheritances and gifts (most)

- GST/ HST credit

- Payouts from life insurance policies

- Withdrawals from TFSA

Annual Canadian Tax Deadline and Rules

In Canada, tax deadlines vary depending on your employment status and the type of business you have. In 2023, The deadline for employed individuals to file their tax return and make a payment is April 30th, while self-employed individuals have until June 15th to file their tax return. It's important to note that self-employed individuals must still pay any taxes owed by April 30th. Large businesses have two months after their year-end to pay their taxes, while small Canadian businesses have up to three months after their year-end.

It's crucial to file your taxes and make payments on time, as the CRA charges a late fee of 5% of the balance owed, with an additional 1% for every month that you're late with your payment.

If you work and live in Canada, you must report your income tax to the Community Reinvestment Act (CRA), which can be done by filing your tax return. With this return, you must list each one of your income sources and take note of your eligibility for possible deductions or credits, if there are any.

The Canadian tax system relies on trust and expects all Canadian residents to be honest about their different sources of income, should there be more than one. They depend on citizens to self-report their income accurately. You must refrain from cheating on your taxes, which is a serious offense in Canada, especially since the Canadian government relies on taxes to look after the country and its people. Should residents not pay taxes, the system would collapse.

If you pay taxes, the Canadian government may redistribute it to you once they determine that you are eligible to receive it, which is decided based on your tax return. By not filing your taxes, you could be missing out on receiving a portion of your tax money back, which also makes it beneficial for you to file it annually. Some tax payouts that you could be eligible for include child tax benefits, GST/ HST credit, and guaranteed income supplements.

Reducing Your Taxes Legally

Taxes are one of the biggest expenses for Canadians, but there are ways to legally reduce the amount you pay. Here are some strategies to help you lower your income tax bill and keep more of your hard-earned money.

Change up Income Sources

If you rely solely on your employment income and interest, you're missing out on opportunities to save money on taxes. Instead, consider investing your money for the long term. Dividends and capital gains are taxed at a lower rate than employment income, so transferring some of your surplus income into your investment portfolio can save you a significant amount in taxes.

Move from a sole proprietorship to an incorporation

If you're a freelancer or small business owner, switching from a sole proprietorship to a corporation can help you reduce your tax rate. While incorporating comes with heavier compliance requirements and a more complicated tax return, it can lower your tax rate from as much as 53.5% to 13.5%. Keep in mind that any payments you make to yourself or others will still be taxed.

Defer taxes

While it's important to meet tax deadlines, you can delay paying your taxes as long as possible without incurring late fees. By investing your money in an RRSP, you can grow your money tax-free until you withdraw it in retirement. While you'll still have to pay taxes eventually, investing your money can help you lower your current marginal tax rate.

Maximize Deductions

The more deductions you can claim, the less tax you'll have to pay. Consider paying for deductions like charitable donations, union dues, medical expenses, RRSP contributions, childcare expenses, and capital losses. Deductions can help you reduce the size of your tax bracket and lower your tax bill.

By implementing these strategies, you can legally reduce the amount you pay in income tax in Canada. While some of these methods require more effort and planning than others, they can all help you keep more of your money in your pocket. As always, consult a tax professional to ensure you're taking advantage of all the tax-saving opportunities available to you.

Canada's International Tax Index

The Tax Foundation's International Tax Competitiveness Index (ITCI) is an annual report that measures the extent to which the tax systems of 38 OECD countries promote competitiveness through low tax burdens on business investment and neutrality through a well-structured tax code. The ITCI considers more than 40 variables across five categories: Corporate Taxes, Individual Taxes, Consumption Taxes, Property Taxes, and International Tax Rules. In this report, we examined the results of the 2021 ITCI and analyzed Canada's performance in the index.

Strengths

According to the 2021 ITCI report, Canada's tax system has several strengths. For example, consumption taxes in Canada are relatively low, although the consumption tax base is relatively narrow. This factor contributes positively to Canada's tax competitiveness. Additionally, Canada allows businesses to immediately write off investments in machinery, which is a pro-growth tax policy that can encourage investment and innovation.

Another positive feature of Canada's tax system is that the country does not levy wealth, estate, or inheritance taxes. This policy encourages capital formation and reduces the burden on families passing on their assets to future generations.

Weaknesses

Despite these strengths, the 2021 ITCI report highlights several weaknesses in Canada's tax system. Firstly, the personal tax on dividends is 39.3 percent, which is significantly higher than the OECD average of 24.2 percent. This high tax rate can discourage investment in Canadian companies and hinder the country's economic growth.

Another area where Canada performs poorly in the ITCI is in the taxation of capital gains. Canada taxes capital gains at a rate of 26.75 percent, which is much higher than the OECD average of 19 percent. This high tax rate can discourage investment in Canada's capital markets and limit the country's economic growth potential.

Finally, the corporate tax rate in Canada is 26.2 percent, which is above the OECD average of 23.6 percent. While this rate is not the highest among OECD countries, it is still a weakness in Canada's tax system, particularly as other countries lower their corporate tax rates to attract investment.

The Canadian Tax Structure for Buyers and Sellers

Given that everybody in Canada must pay tax, yet there is a unique list of criteria and many other factors that determine how much residents need to pay on an annual basis. While lower income-generating individuals have to pay less tax, higher-earning residents must pay significantly more. Depending on how much you earn in Canada is a big factor that determines how much tax you will pay.

Canada has two main types of taxes, which include:

- Value-added tax (VAT) - A goods and services tax (GST), which is assessed by the federal government currently at 5%

- Provincial sales tax (PST) - A tax plan that is assessed by Canada’s provincial governments currently at 7%. PST tax rates vary from province to province, and can be based on the value of goods and services before the federal tax assessment. It can also be based on the value that includes the federal tax assessment.

Different types of taxes in Canada include:

- Goods and Services (GST) - Since January 1991, Canada changed from a federal sales tax to a federal value-added tax, otherwise known as a Goods and Services Tax (GST). Today, provincial taxes are still calculated as a sales tax.

- Provincial Sales Tax (PST) - Every province can calculate PST, which is calculated after the GST gets calculated, which is based on pre-GST value and is based on the value after GST is added, much like a tax on a tax. Every province has different PST rates.

If you are a seller of goods or services, you must remit the federal and provincial taxes to tax authorities. It is also acceptable for a seller to remit the federal tax only, which will require the purchaser to remit provincial tax (self-assessment tax).

Calculate Your Income Tax

Calculating your income tax in Canada can seem overwhelming, but it is a necessary task for all taxpayers. The following steps can help you determine how much income tax you owe.

Step 1: Determine your total income

This includes all the money you earn in a year, including employment income, business income, rental income, investment income, and any other sources of income.

Step 2: Identify your deductions

Deductions are expenses that can be used to reduce your taxable income. Examples of deductions include RRSP contributions, childcare expenses, medical expenses, and charitable donations. You can subtract the total amount of your deductions from your total income.

Step 3: Calculate your taxable income

Your taxable income is your total income minus your deductions.

Step 4: Determine your tax bracket

Canadian tax rates are based on income brackets. The more money you earn, the higher your tax rate. You can find the tax rates for each income bracket on the Canada Revenue Agency (CRA) website.

Step 5: Multiply your income by the applicable tax rate

Once you have determined your tax bracket, you can calculate the amount of tax you owe by multiplying your taxable income by the applicable tax rate for your income bracket. For example, if your taxable income is $50,000 and your tax rate is 20%, your income tax owed would be $10,000.

It's important to note that this is a rough estimate of your income tax owed. There may be additional credits or deductions that you are eligible for that can further reduce your tax bill. It is always recommended to seek advice from a tax professional or use tax software to ensure that you are accurately calculating your income tax. Also, keep in mind that tax laws can change, so it's important to stay up-to-date on any changes to the tax system that could affect your tax liability.

Taxes For Foreigners

Taxes for foreigners in Canada can be a complex and confusing topic, but it's important to understand the rules and regulations to avoid any legal issues. Whether you are a visitor, student, or temporary worker, it is crucial to determine your tax residency status to comply with Canadian tax laws.

Tax residency status depends on several factors, including the duration of your stay, the purpose of your visit, and your ties to Canada. If you are considered a resident of Canada for tax purposes, you will be subject to Canadian income tax on your worldwide income. On the other hand, if you are a non-resident, you will only be taxed on your Canadian-sourced income, such as employment income earned in Canada or rental income from a Canadian property.

As a non-resident, you will need to apply for a tax identification number (TIN) from the Canada Revenue Agency (CRA) if you receive any income from a Canadian source. This number is necessary for filing a tax return and paying any applicable taxes. You may also be eligible for certain deductions and credits, such as the GST/HST credit or the Canada child benefit, depending on your circumstances.

It's important to note that Canada has tax treaties with many other countries to prevent double taxation, where the same income is taxed by both Canada and your home country. These treaties provide guidelines for determining which country has the primary taxing rights and can help reduce your tax burden.

If you are unsure about your tax residency status or have any questions about filing your taxes as a foreigner in Canada, it's best to seek the advice of a qualified tax professional or consult with the CRA. By understanding the rules and regulations, you can ensure that you are compliant with Canadian tax laws and avoid any legal issues in the future.

How Can We Help You?

If you have not applied for permanent Canadian residency yet or are yet to complete your paperwork and process your application, why not consult a professional? Our Regulated Canadian Immigration Consultants (RCICs) are approved by the Canadian government and ready to help you to become a permanent Canadian resident.

FAQs

Do I Have to File a Tax Return if I Don't Owe Any Taxes?

Yes, every person living in Canada must file a tax return, regardless of whether they earn money or not. Filing a tax return is a way to report your income, and even if you don't owe any taxes, you may still be eligible for certain benefits and credits that you can only receive by filing a tax return.

Can I Claim my Medical Expenses as a Deduction on my Tax Return?

Yes, you may be able to claim eligible medical expenses as a deduction on your tax return. Eligible expenses include things like prescription medication, dental and vision care, and medical devices. However, you can only claim expenses that exceed a certain threshold, which is based on your income.

What Happens if I Don't File My Tax Return on Time?

If you don't file your tax return on time, you may be subject to penalties and interest charges. The penalty for late filing is 5% of the balance owing, plus an additional 1% for every month that your return is late, up to a maximum of 12 months. In addition, interest will be charged on any unpaid balance owing, starting from the day after the due date. It's important to file your tax return on time to avoid these charges.